MINISTER OF FINANCE PRESENT INTERIM BUDGET 2024-2025…

|

| INTERIM BUDGET 2024-25 |

INTERIM

BUDGET 2024-2025

NIRMALA SITHARAMAN

MINISTER

OF FINANCE

Introduction

1. The Indian economy has witnessed profound

positive transformation in the last ten years. The people of India are looking

ahead to the future

with hope and optimism. INTERIM BUDGET 2024-2025.

2. With the blessings of the people,

when our Government under the

visionary and dynamic leadership of Hon’ble Prime Minister Shri Narendra Modi assumed office in 2014, the country was facing enormous

challenges. With ‘Sabka Saath,

Sabka Vikas’ as its ‘mantra’, the Government overcame

those challenges in right earnest.

Structural reforms were undertaken. Pro-people programmes were formulated and implemented promptly. Conditions were created for more

opportunities for employment and entrepreneurship. The economy got a new vigour. INTERIM BUDGET 2024-2025.

The fruits of development started reaching the people at scale. The country

got a new sense of purpose and hope. Naturally, the people blessed

the Government with a bigger mandate.

3. In the second term, our Government

under the leadership of Hon’ble Prime

Minister doubled down on its responsibilities to build a prosperous country with comprehensive development of all people and all regions.

Our Government strengthened its ‘mantra’ to ‘Sabka Saath, Sabka Vikas, and Sabka Vishwas’. Our development philosophy covered all elements of inclusivity, namely,

· INTERIM BUDGET 2024-2025.

social inclusivity through coverage

of all strata of the society, and

· INTERIM BUDGET 2024-2025.

geographical inclusivity through development of all regions

of the country.

4. With the ‘whole of nation’ approach

of ‘Sabka Prayas’, the country

overcame the challenge

of a once-in-a-century pandemic, took long strides

towards ‘Atmanirbhar Bharat’, committed to ‘Panch Pran’, and laid solid foundations for the ‘Amrit

Kaal’. As a result, our young country has high aspirations, pride in its present, and hope and

confidence for a bright future. We

expect that our Government, based on its stupendous work, will be blessed again by the people

with a resounding mandate.

Inclusive Development and Growth

5. Our humane and inclusive approach

to development is a marked and

deliberate departure from the earlier approach of ‘provisioning up-to-village level’. Development programmes, in the last ten years, have targeted each and

every household and individual, through

‘housing for all’, ‘har ghar jal’,

electricity for

all, cooking gas for all, bank accounts

and financial services

for all, in record time.

6. The worries about food have been

eliminated through free ration for 80 crore people. Minimum

support prices for the produce of ‘Annadata’ are

periodically increased appropriately. These

and the provision of basic necessities have enhanced real income in the rural areas. Their economic

needs could be addressed, thus spurring growth

and generating jobs. INTERIM BUDGET 2024-2025.

Social justice

7. Our Government is working with an approach

to development that is all-round, all-pervasive and all-inclusive (सर्वांगीण, सर्वस्पर्शी और सर्वसमवर्ेर्शी). It covers all

castes and

people at all levels. We are working

to make India a ‘Viksit Bharat’ by 2047. For achieving that goal, we need to improve people’s

capability and empower

them.

8. Previously, social justice was mostly a political slogan. For our Government, social justice is an effective

and necessary governance model. The saturation approach of covering

all eligible people is the

true and comprehensive achievement of social justice.

This is secularism in action,

reduces corruption, and

prevents

nepotism

(भवई–भतीजवर्वद). There is transparency

and assurance that benefits are delivered to all eligible people. The resources are distributed fairly. All,

regardless of their social standing, get access to opportunities. We are addressing systemic inequalities that had plagued

our society. We focus on

outcomes and not on outlays so that the socio-economic transformation is achieved. INTERIM BUDGET 2024-2025.

9.As our Prime Minister firmly

believes, we need to focus on four major castes. They are, ‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth) and ‘Annadata’ (Farmer). Their needs, their aspirations, and their welfare are

our highest priority. The country progresses, when they progress.

All four require

and receive government

support in their quest to better their lives.

Their empowerment and well-being will drive the country forward.

INTERIM BUDGET 2024-2025.

Garib Kalyan, Desh ka Kalyan

10.We believe in empowering the poor.

The earlier approach of tackling poverty through entitlements had resulted in very modest outcomes. When the poor become

empowered partners in the development

process, government’s power to assist them also

increases manifold. With the pursuit of ‘Sabka

ka Saath’ in these 10 years, the

Government has assisted 25 crore people to get

freedom from multi-dimensional poverty. Our Government’s efforts are now getting synergized with energy and passion of such empowered people.

This is truly elevating them from poverty.

11.‘Direct Benefit Transfer’ of ` 34 lakh crore from the Government using PM-Jan Dhan accounts has led to savings of

` 2.7 lakh crore for the Government. This has been realized through avoidance of leakages prevalent earlier. The savings

have helped in providing more funds for ‘Garib Kalyan’.

12.PM-SVANidhi has provided credit assistance to 78 lakh street

vendors. From that total, 2.3 lakh

have received credit for the third time.

13.PM-JANMAN Yojana reaches out to the particularly vulnerable tribal groups, who have remained outside the realm of development so far. PM-Vishwakarma

Yojana provides end-to- end support

to artisans and craftspeople engaged in 18 trades. The schemes for empowerment of Divyangs and Transgender persons reflect firm resolve of our

Government to leave no one behind.

Welfare of Annadata

14.Farmers are our ‘Annadata’. Every year, under PM-KISAN SAMMAN Yojana, direct

financial assistance is provided to

11.8 crore farmers, including marginal and small farmers. Crop insurance is given to 4 crore farmers under PM Fasal Bima Yojana. These, besides several other

programmes, are assisting ‘Annadata’ in producing food for the country

and the world.

15.Electronic National Agriculture Market has integrated 1361 mandis, and is providing services to 1.8 crore farmers with trading

volume of ` 3 lakh

crore.

16.The sector is poised for inclusive,

balanced, higher growth and productivity. These are facilitated from farmer-centric policies, income support, coverage

of risks through

price and insurance support, promotion of technologies and innovations through start-ups.INTERIM BUDGET 2024-2025.

Empowering Amrit Peedhi, the Yuva

17.Our prosperity depends on adequately equipping

and empowering the youth. The

National Education Policy 2020 is ushering

in transformational reforms. PM ScHools for Rising India (PM SHRI) are delivering quality teaching, and nurturing

holistic and well-rounded individuals.

18.The Skill India Mission

has trained 1.4 crore youth, upskilled

and reskilled 54 lakh youth, and established 3000 new ITIs. A large number of new institutions of higher learning,

namely 7 IITs, 16 IIITs, 7 IIMs, 15 AIIMS and 390 universities have been set up.

19.PM INTERIM BUDGET 2024-2025.

Mudra Yojana has sanctioned 43 crore loans aggregating to ` 22.5 lakh crore for entrepreneurial aspirations of our youth. Besides that, Fund of

Funds, Start Up India, and Start Up

Credit Guarantee schemes are assisting our youth. They are also becoming ‘rozgardata’.

20.The country is proud of our youth

scaling new heights in sports. The

highest ever medal tally in Asian Games and Asian Para Games in 2023 reflects

a high confidence level. Chess prodigy

and our Number-One ranked player Praggnanandhaa put up a stiff fight against

the reigning World Champion Magnus

Carlsson in 2023. Today, India has over 80 chess grandmasters compared

to little over 20 in 2010. INTERIM BUDGET 2024-2025.

Momentum for Nari Shakti

21.The empowerment of women through

entrepreneurship, ease of living, and

dignity for them has gained momentum in these ten years.

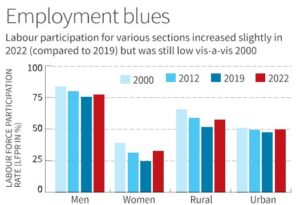

22.Thirty crore Mudra Yojana loans have been given to women entrepreneurs. Female enrolment in higher education has gone up by twenty-eight per cent in ten years. In STEM courses, girls and women constitute forty-three per cent of enrolment

– one of the highest in the world. All these measures are getting reflected in the increasing participation of women

in workforce.

23.Making ‘Triple Talaq’ illegal,

reservation of one-third seats for

women in the Lok Sabha and State legislative assemblies, and giving over seventy per cent houses under

PM Awas Yojana in rural areas to women as sole or

joint owners have enhanced their

dignity. INTERIM BUDGET 2024-2025.

Exemplary Track Record of Governance, Development and Performance (GDP)

24.Besides delivering on high growth in terms of Gross Domestic Product, the Government is

equally focused on a more comprehensive ‘GDP’, i.e., ’Governance, Development and Performance’.

25.Our Government has provided

transparent, accountable, people-centric and prompt trust-based administration with ‘citizen-first’ and ‘minimum government, maximum governance’ approach.

26.The impact of all-round development

is discernible in all sectors. There is macro-economic stability, including in the external sector. Investments are robust.

The economy is doing well.

27.People are living better and earning

better, with even greater

aspirations for the future. Average real income of the people has increased

by fifty per cent. Inflation

is moderate. People are getting empowered, equipped

and enabled to pursue their aspirations. There is effective

and timely delivery

of programmes and of large projects. INTERIM BUDGET 2024-2025.

Economic Management

28.The multipronged economic management over the past ten years has complemented people-centric inclusive development. Following are some of the

major elements.

(1)All forms of infrastructure,

physical, digital or social, are being built in record time.

(2)All parts of the country are becoming active participants in economic growth.

(3)Digital Public Infrastructure, a new ‘factor

of production’ in the 21st century, is instrumental in formalization of the

economy.

(4)Goods and Services Tax has enabled ‘One Nation, One Market, One Tax’. Tax reforms have led to deepening and widening of tax base.

(5)Strengthening of the financial

sector has helped in making savings,

credit and investments more efficient.

(6)GIFT IFSC and the unified

regulatory authority, IFSCA are

creating a robust gateway for global capital and financial services for the economy.

(7)Proactive inflation management has helped keep inflation within the

policy band.

Global

Context

29.Geopolitically, global affairs are

becoming more complex and challenging

with wars and conflicts. Globalization is being redefined with reshoring

and friend-shoring, disruption and fragmentation of supply chains,

and competition for critical minerals and technologies. A new world

order is emerging after the Covid pandemic.

30.India assumed G20 Presidency during

very difficult times for the world. The global economy

was going through

high inflation, high interest

rates, low growth, very high public debt, low

trade growth, and climate challenges. The pandemic had led to a crisis of food, fertilizer, fuel and

finances for the world, while India successfully navigated its way. The

country showed the way forward and built consensus on solutions for those global problems.

31.The recently announced India-Middle East-Europe Economic

Corridor is a strategic and economic game changer for India and others. In the words of Hon’ble Prime Minister, the corridor “will become the basis of world trade for hundreds of years to come, and history will remember

that this corridor was initiated on Indian soil”.

Vision for ‘Viksit Bharat’ INTERIM BUDGET 2024-2025.

32.Our vision for ‘Viksit Bharat’ is that of “Prosperous Bharat in harmony with nature, with modern infrastructure, and providing

opportunities for all citizens and all regions to reach their potential”.

33.With confidence arising from strong

and exemplary track- record of

performance and progress earning ‘Sabka

Vishwas’, the next five years

will be years of unprecedented development, and golden moments to realize the dream of developed India @ 2047. The trinity

of demography, democracy

and diversity backed by ‘Sabka Prayas’ has the potential to fulfill aspirations of every

Indian.

34.As Hon’ble Prime Minister

in his Independence Day address

to the nation mentioned, “There is no dearth of opportunities; as many opportunities as we want. The country is capable of creating

more opportunities. Sky’s the limit”.

Strategy for ‘Amrit Kaal’

35.Our Government will adopt economic

policies that foster and sustain

growth, facilitate inclusive

and sustainable development, improve productivity, create

opportunities for all, help them enhance their capabilities, and contribute to generation of resources to power investments and fulfil aspirations.

36.Guided by the principle ‘Reform,

Perform, and Transform’, the

Government will take up next generation reforms, and build consensus

with the states and stakeholders for effective implementation.

37.It is an important policy priority

for our Government to ensure timely

and adequate finances, relevant technologies and appropriate training for the Micro, Small and Medium Enterprises (MSME) to grow and also

compete globally. Orienting the

regulatory environment to facilitate their growth will be an important

element of this policy mix.

38.Aligning with the ‘Panchamrit’ goals, our Government will facilitate sustaining high and more

resource-efficient economic growth. This will work towards energy security in terms of availability, accessibility and affordability.

39.For meeting the investment needs

our Government will prepare the

financial sector in terms of size, capacity, skills and regulatory framework.

Aspirational Districts

Programme

40.Our Government stands ready to

assist the states in faster development of aspirational districts

and blocks, including

generation of ample economic

opportunities.

Development of the East

41.Our Government will pay utmost

attention to make the eastern region and its people

a powerful driver of India’s growth.

PM Awas Yojana

(Grameen)

42.Despite the challenges due to

COVID, implementation of PM Awas Yojana (Grameen)

continued and we are close to achieving

the target of three crore houses. Two crore more houses will be taken up in the next five years to meet the requirement arising from increase in the number of families.

Rooftop solarization and muft bijli

43.Through rooftop solarization, one

crore households will be enabled to

obtain up to 300 units free electricity every month. This scheme follows the resolve of Hon’ble Prime Minister on

the historic day of consecration of Ram Mandir in Ayodhya.

Following benefits are expected.

a.Savings up to fifteen

to eighteen thousand

rupees annually for households

from free solar electricity and selling

the surplus to the distribution companies;

b. Charging of electric vehicles;

c. Entrepreneurship opportunities for a large

number of vendors

for supply and installation;

d.Employment opportunities for the youth

with technical skills in manufacturing, installation and maintenance;

Housing for middle class

44.Our Government will launch a scheme

to help deserving sections of the

middle class “living in rented houses, or slums, or chawls and unauthorized colonies” to buy or build their own houses.

Medical Colleges

45.Several youth are ambitious to get

qualified as doctors. They aim to serve our people through improved

healthcare services. Our

Government plans to set up more medical colleges by utilizing the existing hospital

infrastructure under various

departments. A committee

for this purpose

will be set-up to examine

the issues and make relevant

recommendations.

Cervical Cancer Vaccination

46.Our Government will encourage

vaccination for girls in age group of 9 to 14

years for prevention of cervical

cancer.

Maternal and child health

care

47.Various schemes for maternal

and child care will be brought under one comprehensive programme for synergy

in implementation. Upgradation of anganwadi centres

under “Saksham Anganwadi

and Poshan 2.0” will be expedited for improved nutrition delivery, early childhood care and development.

48.The newly designed U-WIN platform for managing immunization and intensified efforts

of Mission Indradhanush will be rolled

out expeditiously throughout the country.

Ayushman Bharat

49.Healthcare cover under Ayushman

Bharat scheme will be extended to all ASHA workers, Anganwadi

Workers and Helpers.

Agriculture and food processing

50.The efforts for value addition in agricultural sector and boosting farmers’ income will be stepped

up. Pradhan Mantri Kisan Sampada

Yojana has benefitted 38 lakh farmers

and generated 10 lakh

employment. Pradhan Mantri Formalisation of

Micro Food Processing Enterprises Yojana has assisted 2.4 lakh SHGs and sixty thousand individuals with

credit linkages. Other schemes are complementing the efforts for reducing post- harvest losses,

and improving productivity and incomes.

51.For ensuring faster growth of the

sector, our Government will further

promote private and public investment in post-harvest activities including aggregation, modern storage, efficient supply chains, primary and

secondary processing and marketing and branding.

Nano DAP

52.After the successful adoption of

Nano Urea, application of Nano DAP on

various crops will be expanded in all agro-climatic zones.

Atmanirbhar Oil Seeds Abhiyan

53.Building on the initiative announced in 2022, a strategy will be formulated to achieve ‘atmanirbharta’ for oil seeds such as mustard, groundnut, sesame, soybean, and sunflower. This will cover research for high-yielding varieties, widespread adoption of modern farming

techniques, market linkages,

procurement, value addition, and crop insurance.

Dairy Development

54.A comprehensive programme for

supporting dairy farmers will be

formulated. Efforts are already on to control foot and mouth disease. India is the world’s largest milk producer but with low

productivity of milch-animals. The programme will be built on the success of existing schemes such Rashtriya Gokul Mission,

National Livestock Mission,

and Infrastructure Development Funds for dairy processing and animal husbandry.

Matsya Sampada

55.It was our Government which set up a separate Department for Fisheries realizing

the importance of assisting fishermen. This has resulted

in doubling of both inland and aquaculture production. Seafood export

since 2013-14 has also doubled. Implementation of Pradhan Mantri Matsya Sampada Yojana (PMMSY) will be stepped

up to:

(1)enhance aquaculture productivity from existing 3 to 5 tons per hectare,

(2)double exports

to ` 1 lakh crore

and

(3)generate 55 lakh employment opportunities in near future.

Five integrated aquaparks will be setup.

Lakhpati Didi

56.Eighty-three lakh SHGs with nine crore women are transforming rural socio-economic landscape

with empowerment and self-reliance. Their success has assisted nearly one crore women to become Lakhpati

Didi already. They are an inspiration to others. Their achievements will be recognized through honouring them. Buoyed

by the success, it has been decided to enhance the target for Lakhpati Didi from 2 crore

to 3 crore.

Technological Changes

57.New age technologies and data are

changing the lives of people and businesses. They are also enabling

new economic opportunities and

facilitating provision of high-quality services at affordable prices for all, including

those at ‘bottom

of the pyramid’. Opportunities for India at the global

level are

expanding. India is showing solutions through innovation and entrepreneurship of its people.

Research and Innovation for catalyzing growth,

employment and development

58.Prime Minister Shastri gave the

slogan of “Jai Jawan Jai Kisan”. Prime Minister Vajpayee made

that “Jai Jawan Jai Kisan Jai Vigyan”. Prime

Minister Modi has furthered that to “Jai Jawan Jai Kisan Jai Vigyan and Jai

Anusandhan”, as innovation is the foundation of development.

59.For our tech savvy youth, this

will be a

golden era. A corpus of rupees one lakh crore will be established with fifty-year

interest free loan. The corpus will provide long-term financing or refinancing with long tenors and low or nil

interest rates. This will encourage

the private sector to scale up research and

innovation significantly in sunrise domains. We need to have programmes that combine the powers of our youth and technology.

60.A new scheme will be launched

for strengthening deep-tech

technologies for defence

purposes and expediting ‘atmanirbharta’.

Infrastructure Development

61.Building on the massive tripling of

the capital expenditure outlay in the

past 4 years resulting in huge multiplier impact on economic growth and employment creation, the outlay for the next year is being increased

by 11.1 per cent to eleven lakh, eleven thousand, one hundred and eleven crore rupees (` 11,11,111 crore).

This would be 3.4 per cent of

the GDP.

Railways

62.Three major economic railway corridor programmes will be implemented. These are:

(1)energy, mineral and cement corridors,

(2)port connectivity corridors, and

(3)high traffic density

corridors.

The projects have been identified under the PM Gati Shakti for enabling

multi-modal connectivity. They will improve

logistics efficiency and reduce cost.

63.The resultant decongestion of the

high-traffic corridors will also help in improving operations of passenger trains,

resulting in safety and higher travel speed for passengers. Together with dedicated freight corridors, these three economic corridor programmes will accelerate our

GDP growth and reduce logistic costs.

64.Forty thousand normal rail bogies

will be converted to the Vande Bharat standards to enhance safety,

convenience and comfort

of passengers.

Aviation Sector

65.The aviation sector has been galvanized in the past ten years.

Number of airports

have doubled to 149. Roll out of air connectivity to tier-two and tier-three cities under UDAN

scheme has been widespread. Five

hundred and seventeen new routes are carrying

1.3 crore passengers. Indian carriers

have pro-actively placed

orders for over 1000 new aircrafts. Expansion

of existing airports

and development of new airports

will continue expeditiously.

Metro and NaMo Bharat

66.We have a fast-expanding middle class and rapid urbanization

is taking place. Metro Rail and NaMo

Bharat can be the catalyst for the

required urban transformation. Expansion of these systems

will be supported in large cities focusing

on transit-oriented development.

Green Energy

67.Towards meeting our commitment for

‘net-zero’ by 2070, the following measures will be taken.

a.Viability gap funding will be

provided for harnessing offshore wind

energy potential for initial capacity of one giga-watt.

b.Coal gasification and liquefaction

capacity of 100 MT will be set up by

2030. This will also help in reducing imports of natural gas, methanol,

and ammonia.

c.Phased mandatory blending of compressed biogas (CBG)

in compressed natural gas (CNG) for transport

and piped natural gas (PNG) for domestic purposes will be mandated.

d.Financial assistance will be provided for procurement of biomass aggregation machinery to support

collection.

Electric Vehicle Ecosystem

68.Our Government will expand and

strengthen the e-vehicle ecosystem by supporting manufacturing and charging infrastructure. Greater adoption of

e-buses for public transport networks will be encouraged through payment security

mechanism.

Bio-manufacturing and Bio-foundry

69.For promoting green growth,

a new scheme of bio-manufacturing and bio-foundry will be launched.

This will provide environment friendly

alternatives such as biodegradable polymers,

bio-plastics, bio-pharmaceuticals and bio-agri-inputs. This scheme will also help in transforming today’s consumptive manufacturing paradigm to the one based on regenerative principles.

Blue Economy 2.0

70.For promoting climate resilient

activities for blue economy 2.0, a scheme for restoration and adaptation measures,

and coastal aquaculture and mariculture with integrated and multi-sectoral

approach will be launched.

Comprehensive development of tourist centres

71.The success of organizing G20 meetings in sixty places presented

diversity of India to global audience. Our economic strength has made the country

an attractive destination for business and conference tourism.

Our middle class also now aspires to travel and explore. Tourism,

including spiritual tourism,

has tremendous opportunities for local entrepreneurship.

72.States will be encouraged to take up comprehensive development of iconic tourist centres,

branding and marketing them at global

scale. A framework for rating of the centres based on quality of facilities and services will be established.

Long-term interest free loans will be

provided to States for financing such development on matching basis.

73.To address the emerging

fervour for domestic

tourism, projects for port connectivity, tourism infrastructure, and amenities will be taken up on our islands,

including Lakshadweep. This will help in generating employment also.

Promoting Investments

74.The FDI inflow during 2014-23 was

USD 596 billion marking a golden

era. That is

twice the inflow

during 2005-14. For encouraging sustained

foreign investment, we are negotiating bilateral investment treaties

with our foreign

partners, in the spirit

of ‘first develop India’.

Reforms in the States

for ‘Viksit Bharat’

75.Many growth and development enabling reforms are needed in the states

for realizing the vision of ‘Viksit Bharat’. A provision of seventy-five thousand

crore rupees as fifty-year interest free loan is proposed this year to support those milestone-linked reforms

by the State Governments.

Societal Changes

76.The Government will form a

high-powered committee for an

extensive consideration of the challenges arising

from fast population growth and demographic changes. The committee will be mandated to make recommendations for addressing these challenges comprehensively in relation to the goal of ‘Viksit Bharat’.

Amrit Kaal as

Kartavya Kaal

77.Our Government stands committed to

strengthening and expanding the economy with high growth and to create conditions for people to realize their

aspirations. Hon’ble Prime Minister in his Independence Day address

to the nation, in the 75th year of

our Republic said; we “commit ourselves

to national development, with new inspirations, new consciousness, new resolutions,

as the country opens up immense possibilities and opportunities”. It is our

‘Kartavya Kaal’.

78.Every challenge of the pre-2014 era was overcome

through our economic management and our governance. These have placed the country on a resolute

path of sustained

high growth. This has been

possible through our right policies, true intentions,

and appropriate decisions. In the full budget in July, our Government will present a detailed roadmap for our pursuit of ‘Viksit Bharat’.

Revised Estimates

2023-24

79.The Revised Estimate of the total receipts other than borrowings is ` 27.56 lakh crore, of which the tax receipts

are

`

23.24 lakh crore. The Revised Estimate of the total

expenditure is ` 44.90 lakh

crore.

80.The revenue receipts at ` 30.03

lakh crore are expected to be higher than the Budget Estimate,

reflecting strong growth

momentum and formalization in the economy.

81.The Revised Estimate of the fiscal

deficit is 5.8 per cent of GDP, improving

on the Budget Estimate, notwithstanding moderation in the nominal

growth estimates.

Budget Estimates 2024-25

82.Coming to 2024-25, the total receipts

other than borrowings and the total expenditure are

estimated at ` 30.80 and

47.66 lakh crore respectively. The tax receipts are estimated at ` 26.02 lakh crore.

83.The scheme of fifty-year interest free loan for capital

expenditure to states will be continued this year with total outlay of ` 1.3 lakh crore.

84.We continue on the path of fiscal consolidation, as announced in my

Budget Speech for 2021-22, to reduce fiscal deficit below 4.5 per cent by 2025-26. The fiscal deficit

in 2024-25 is estimated to be

5.1 per cent of GDP, adhering to that path.

85.The gross and net market borrowings through dated securities during 2024-25 are estimated at ` 14.13 and

11.75 lakh crore respectively. Both will be less than that in 2023-24. Now that the private investments are happening at scale, the lower borrowings by the Central

Government will facilitate larger availability of credit for the

private sector.

Vote on Account

86.I will be seeking ‘vote on account’ approval

of the Parliament through the Appropriation Bill for a part of the financial

year 2024-25.

I will, now, move to Part B.

Part B

Hon’ble Speaker Sir,

Direct taxes

87.Over the last ten years, the direct tax collections have

more than trebled

and the return

filers swelled to 2.4 times.

I would like to assure the taxpayers that their contributions have been used wisely for the development of the country

and welfare of its people.

I appreciate the tax payers for their support.

88.The Government has reduced and

rationalized tax rates. Under the new

tax scheme, there is now no tax liability for tax payers with income up to ₹ 7 lakh, up from ₹ 2.2 lakh in the financial year 2013-14. The threshold for

presumptive taxation for retail

businesses was increased from ₹ 2 crore to ₹ 3 crore. Similarly, the threshold for professionals eligible for

presumptive taxation was increased from ₹ 50 lakh to ₹ 75 Lakh. Also, corporate

tax rate was decreased from 30 per cent to 22 per cent for existing domestic companies and to 15 per cent for certain new manufacturing companies.

89.In the last five years, our focus has been to improve tax-payer

services. The age-old

jurisdiction-based assessment system was transformed with the introduction of Faceless Assessment and Appeal, thereby

imparting greater efficiency, transparency and accountability. Introduction of updated income tax returns, a new Form 26AS and prefilling of tax returns

have made filing of tax returns simpler and easier. Average processing time of returns

has been reduced

from 93 days in the year 2013-14 to a mere ten days this year,

thereby making refunds faster.

Indirect Taxes

90.By unifying the highly fragmented

indirect tax regime in India, GST has reduced

the compliance burden on trade and industry. The industry has acknowledged the benefits of GST. According to a recent survey conducted by

a leading consulting firm, 94 per

cent of industry leaders view the transition to GST as largely positive. According to 80 per cent of the respondents,

it has led to supply chain optimisation, as elimination of tax arbitrage and octroi has resulted in

disbanding of check posts at state and city boundaries. At the same time, tax base of GST more than doubled

and the average monthly gross GST collection has almost doubled to ₹ 1.66

lakh crore, this year. States too have benefited. States’ SGST revenue,

including compensation released

to states, in the post-GST

period of 2017-18

to 2022-23, has achieved a buoyancy of 1.22. In contrast, the tax

buoyancy of State revenues

from subsumed taxes in the

pre-GST four-year period of 2012-13 to 2015-16 was a mere 0.72. The biggest

beneficiaries are the consumers, as reduction in logistics

costs and taxes have brought down prices

of most goods and

services.

91.We have taken a number of steps in

Customs to facilitate international

trade. As a result, the import release time declined by 47 per cent to 71 hours at Inland Container Depots, by 28 per cent to 44 hours at air cargo

complexes and by 27 per cent to 85

hours at sea ports, over the last four years since 2019, when the National

Time Release Studies were first

started.

Tax proposals

92.As for tax proposals, in keeping

with the convention, I do not propose

to make any changes relating

to taxation and propose

to retain the same tax rates for direct taxes and indirect taxes including import duties. However,

certain tax benefits to start-ups and

investments made by sovereign wealth or pension funds as also tax exemption on certain income of some IFSC units are expiring on 31.03.2024. To provide continuity in taxation, I propose

to extend the date to 31.03.2025.

93.Moreover, in line with our

Government’s vision to improve ease of living and ease

of doing business, I wish to

make an announcement to improve tax

payer services. There are a large number

of petty, non-verified, non-reconciled or disputed direct tax demands, many of them dating as far

back as the year 1962, which continue

to remain on the books, causing anxiety

to honest tax payers and hindering refunds

of subsequent years.

I propose to withdraw such outstanding direct tax demands

up to twenty-five thousand rupees (₹ 25,000)

pertaining to the period up to financial

year 2009-10 and up to ten-thousand rupees (₹ 10,000) for financial years 2010-11 to 2014-15. This is expected to benefit about a crore tax-payers.

Economy – Then and Now

94.In 2014 when our Government assumed

the reins, the responsibility

to mend the economy step by step and to put the governance systems in order was enormous. The need of the hour was to give hope to the people, to

attract investments, and to build

support for the much-needed reforms. The Government did that successfully following

our strong belief

of ‘nation-first’.

95.The crisis of those years has been overcome,

and the economy has been put firmly on a high sustainable growth path with all-round development. It is now appropriate to look at where we were then till 2014 and where we are now, only for the purpose of drawing lessons

from the mismanagement of those years. The

Government will lay a White Paper on table of

the House.

96.The exemplary track record of

governance, development and

performance, effective delivery, and ‘Jan

Kalyan’ has given the Government

trust, confidence and blessings of the people to realize, whatever it takes, the goal of ‘Viksit Bharat’ with good intentions,

true dedication and hard work in the coming years and decades.

97.With this, I commend the interim

budget to this august House.